Noah’s Quarter 4 Economic Update

Hello, PEG Members!

Welcome to the 2026 Economic Outlook from PEG. On the heels of a politically chaotic, but economically resilient 2025, our sources at Dodge Construction, ITR Economics, TM Capital, Rouse Analytics, and the ARA are expecting a tough, but prosperous 2026.

“Economic nationalism is increasing and, while the impact of tariffs typically fades quickly there are other motivators to shorten and secure supply chains to reduce risks. Reshoring and foreign investments into US enterprises are both rising.” – ITR Executive Summary, December 2025

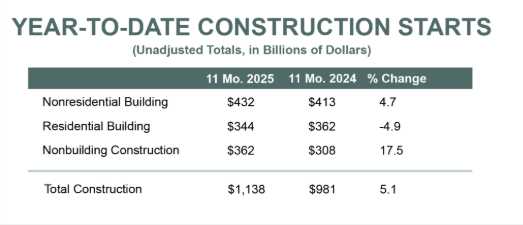

The Dodge Momentum Index (DMI), which is a monthly measure based on the three-month moving value of nonresidential building projects going into planning, decreased by 1.1% in November 2025 from October 2025’s reading. Despite this drop in momentum, construction starts in 2025 are up 5.1% from 2024. – Dodge Construction

As per before, this report focuses on the changes in the current construction markets, supply for equipment, current equipment value reports, the labor market, and strategies for the beginning of 2026.

Demand: Single-unit Residential and Gov’t Infrastructure continues to dip with growth in Multi-unit and Private Construction

Overall construction starts were up 5.1% in November 2025 from November 2024.

- Dodge Construction

Within the starts, Nonresidential building has grown 4.7%, residential building has dropped 4.9%, and nonbuilding construction has grown 17.5%.

“Regionally, total construction starts in November rose in the Northeast (+17.9% month/month) and the West (+3.7% m/m). Starts declined in the South Central (-49.2% m/m), Midwest (-7.7% m/m), and the South Atlantic (-8.4% m/m) between October and November.” – Dodge Construction

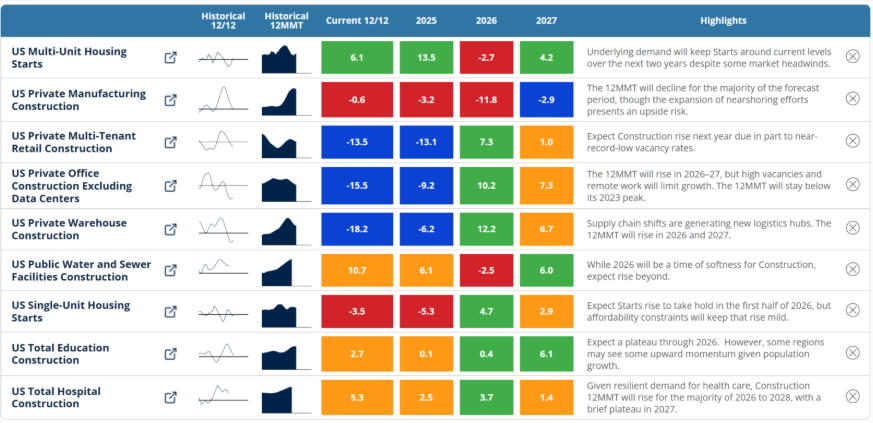

Diving deeper into the weeds, ITR mirrors the sentiment of Dodge Construction.

- ITR, The Construction US Economy at-a-Glance, December 2025 Dashboard

We see strong growth in Multi-Unit Housing and recoveries beginning with private building construction. In public buildings (public facilities, education, hospitals) we see growth starting to soften, expecting plateaus and lower growth rates through 2026. Lastly, we see single-unit housing continue to fall as affordability constraints for homeowners remain a pain point. Speaking to affordability constraints, this explains the continued growth in multi-unit housing starts, as more would-be homeowners replace single-unit housing with apartments or condos in multi-unit buildings. We are also seeing high costs of construction and structural barriers putting downside pressure on the housing market.

RE: Outlook - we see more of the same; “Overall, nonresidential construction is expected to strengthen in 2027, led primarily by data center and healthcare projects.” - Dodge Construction

Supply: Strength in Industry, Nondefense Capital Goods New Orders, US Machinery/Construction Machinery New Orders

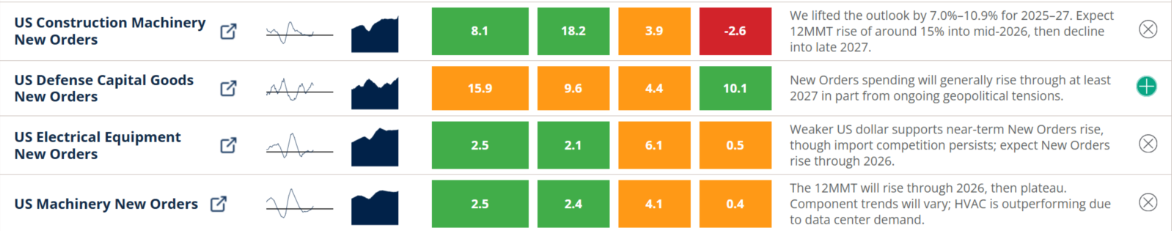

Regarding new machinery entering the market, Nondefense Capital Goods New Orders are up 2.1% from the year-ago level, with an expected rise and softening in ’26 and ’27. Stronger inventory turns bode well for New Orders into at least the middle of next year.

- ITR, The Manufacturing US Economy at-a-Glance, December 2025 Dashboard

US Construction Machinery maintains a strong growth outlook for 2026, with an estimated 18.2% growth rate. This reflects a great demand for Construction Machinery, and with the perceived volatility in the market, it is a great time to continue selling rental to your customers as a safer alternative to ownership of machines.

Looking at current value, Rouse’s December 2025 Report, shows that the Fair Market Value (FMV) and Forced Liquidation Value (FLV) for almost all pieces of equipment are down from their July 2024 levels. The categories that are closest to their July 2024 values are: Excavators, Forklift Trucks, Truck Tractors, and the FLV or support equipment.

RE: Outlook - Businesses are expected to accelerate their spending in 2026, enabled by ample cash balance, plenty of liquidity, and moderate interest rates. However, ITR warns; “Businesses must remain vigilant to the potential for profitless prosperity, as persistent inflation poses a risk to margins. As a baseline, Producer Prices will rise by around 2%-3% per year in 2026 and 2027, but some individual inputs could rise faster. Be ready to battle back with efficiencies and competitive advantages.”

For our members in dealerships and distributorships, it is ever important to focus on growing your margins through service and rental activity and continuing a focus on equipment prices.

Private Sector Employment: Softened slightly, but will remain tight in the coming years

ITR reports that demographic trends have caused for the labor market to remain relatively tight in the coming years. Within our network, we continue to see the need for developing talent, with mechanics lowering in supply. In addition, our event companies continue to face challenges regarding H2B and part-time labor.

The Year Behind and the Year Ahead:

“The American Rental Association indicates a continued softening in growth for rental revenue in the U.S. equipment rental industry for 2025. The most current projections indicate a 3.3 percent revenue increase in 2025 totaling $80.5 billion in construction and general tool rental revenue, and 2.3% growth in 2026 totaling $82.3 billion.” – ARA Q4 Economic Report

“The year is playing out better than we originally expected, [and] our updated guidance reflects the demand environment we continue to successfully serve… The demand for used equipment also remains healthy.

By vertical, our construction end markets saw strong growth across both infrastructure and nonresidential construction, while our industrial end markets saw particular strength within power. We continue to see new projects kicking off, and while data centers are certainly one area of growth, we also saw new projects across infrastructure, [semiconductors], hospitals, LNG facilities and airports to name just a few.” – Matthew J. Flannery, President & CEO of United Rentals

The year ahead looks tough with softening growth in public projects, recovery in private projects, and affordability issues in the housing market. Similarly, tariff involvement creates a margin-squeeze on equipment as pricing increases on machinery.

Fortunately, demand for machinery is high, construction continues to be resilient, and boons such as data centers, hospitals, and multi-unit housing continue to grow the market. Here’s to 2026, let’s have a great one.

If you would like any further analysis feel free to reach out to Dan (dcrowley@peerexecutivegroups.com), Charlie (cpetersen@peerexecutivegroups.com), or I (ncrowley@peerexecutivegroups.com) for more information.